Throughput Accounting

Personalize This

Get insights for your role

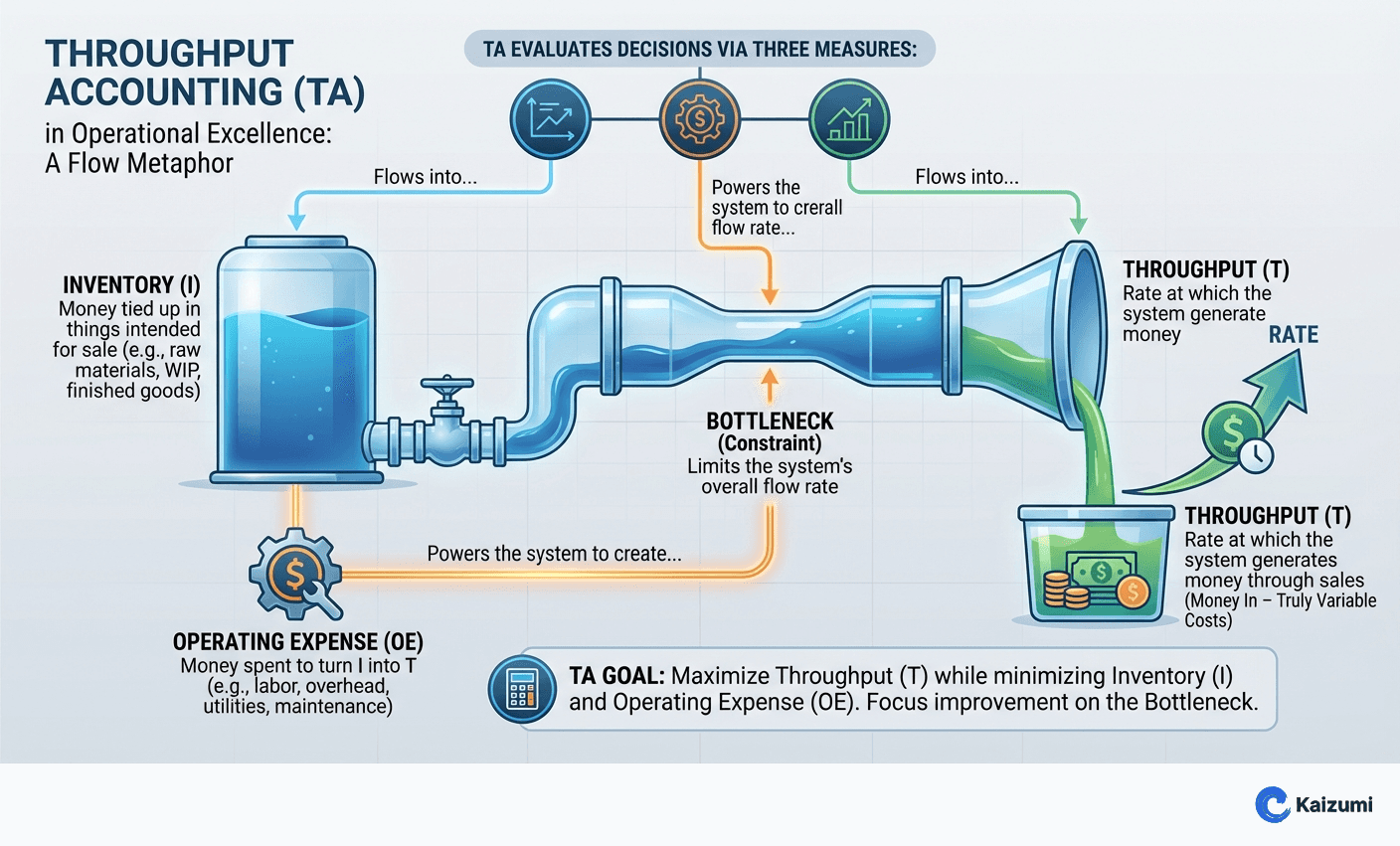

Throughput Accounting is a TOC decision-making method that evaluates choices based on their impact on Throughput, Inventory, and Operating Expense.

Definition

Throughput Accounting (TA) is a management accounting approach from Theory of Constraints that evaluates decisions based on three measures: Throughput (T)—the rate at which the system generates money through sales; Inventory (I)—money tied up in things intended for sale; and Operating Expense (OE)—money spent converting inventory into throughput. Good decisions increase T, decrease I, and decrease OE. TA prioritizes throughput over cost reduction, recognizing that profit comes from selling, not from cutting costs alone.

Examples

Traditional accounting rejected an order because product gross margin was "below standard." Throughput Accounting analysis showed: the order used only non-constraint capacity (no impact on other throughput), would generate $50,000 revenue with $15,000 truly variable costs = $35,000 throughput contribution. The order was accepted profitably.

Key Points

- Three measures: Throughput, Inventory, Operating Expense

- Good decisions increase T, decrease I, decrease OE (in that priority order)

- Throughput = Revenue minus truly variable costs (typically just materials)

- Challenges traditional cost allocation that hides constraint economics

Common Misconceptions

Throughput Accounting ignores costs. TA tracks Operating Expense carefully—it just doesn't allocate OE to products. OE matters, but absorbing it into product costs creates false signals about which products generate profit.

Throughput = Revenue. Throughput is revenue minus truly variable costs—costs that change directly with each additional unit sold (usually just materials and outside processing). Labor and overhead are Operating Expense, not variable.